Protecting Land

Since 1994, Three Valley Conservation Trust has been recognized by farmers, landowners, and public officials in Southwest Ohio as an important resource for land protection, conservation planning, and environmentally-responsible development.

Easements

Want to know more about all types of Easements?

Donation of a Conservation Easement

A Conservation Easement is considered a qualifying charitable donation by the US Internal Revenue Service. Thus, the landowner may be eligible for a federal income tax deduction equal to the appraised valuation of the easement donation – the difference between the land’s fair market value with and without the easement in place. In addition, estate taxes could be reduced, making it easier for heirs to keep the property intact.

Purchase of a Conservation Easement

Landowners placing their land under easement sometimes receive funding from certain federal and/or state funded, competitive programs. Each program is different, depending on the type and use of the land the program conserves, and each follows a unique methodology and timeline.

These programs include:

Ohio Dept. of Agriculture’s Clean Ohio Local Agricultural Easement Purchase Program (ODA LAEPP) Website link here

The LAEPP program allows local landowners to voluntarily sell property development rights via agricultural an easement to the State of Ohio. The easement limits the use of land to predominately agricultural activity. The land remains under private ownership and management, and stays on tax rolls under Current Agricultural Use Value (CAUV). The farmland can be sold or passed along as a gift to others at any time, but restrictions prohibiting non-agricultural development stay with the land in perpetuity. The LAEPP program contributes up to 75 percent of the fair market value of the agricultural land easement, with a max of $2,000 per acre.

Qualifying farms must be:

1. At least 40 contiguous acres (exceptions may be considered)

2. Currently enrolled in CAUV and the Agricultural District Program through the county auditor’s office.

3. The landowner must demonstrate good stewardship of the property and possess a clean title. The successful applicants will need to have support from their local government for the easement.

TVCT has an estimated $214,241 to distribute to agricultural landowners in Butler and Preble Counties through LAEPP’s 2022 funding round. The 2022 funding round is from January 18, 2022, through April 18, 2022. ODA funding selectees will be announced in summer 2022.

Interested? Please fill out an Landowner Interest Form

Additional ODA Easement Documents for Review:

Sample ODA Easement Deed Language

Ag District Form (filed with your county auditor) - This is beneficial to non-applicants as well

Program Informational Documents:

Ohio Dept. of Ag Easement Handbook

Ohio Dept. of Ag Policies and Guidelines

General Easement Informational Documents:

Tax Breaks for Land Preservation-WSJ.com

US Department of Agriculture – Natural Resources Conservation Service’s Agricultural Conservation Easement Program – Agricultural Land Easements (NRCS ACEP-ALE) Website link here

NRCS provides financial assistance to eligible partners for purchasing Agricultural Land Easements that protect the agricultural use and conservation values of eligible land. In the case of working farms, the program helps farmers and ranchers keep their land in agriculture. The program also protects grazing uses and related conservation values by conserving grassland, including rangeland, pastureland and shrubland. Under the Agricultural Land component, NRCS may contribute up to 50 percent of the fair market value of the agricultural land easement. NRCS’s ACEP-ALE 2022 funding round closed on December 3rd, 2021. An additional funding round may be held later in 2022.

NRCS Easement Language Sample Here

Donation of Fee Simple Property to the Three Valley Conservation Trust

- You transfer property to TVCT and secure a charitable income tax deduction based on the fair market value of the property

- You pay no capital gains taxes on the property appreciation

- You can apply the deduction for 50% of your adjusted gross income and carry it forward for up to 16 years*

*Subject to legislative change

Easement Process - Getting Started

Interested landowners should first contact us to see if their property would be a good candidate for a conservation easement.

Landowners can reach our land protection staff by calling

513-524-2150

(

Ext. 2) or emailing

landstew2@3vct.org .

Once we have determined a conservation easement is right for your property, we will have you fill out our intent to apply form (

found here ), so we can learn more about your property and its history.

We will identify if your property is eligible for any state or federal funding programs or if a donated easement is a better fit for your needs.

FUNDED EASEMENT PROCESS

If you would like to protect your property with a funded easement, we will identify which program is best for your needs. TVCT will prepare your application and work with you to obtain necessary application documents. The application to closing timeline depends on the funding program and can take up to 1 or 2 years. However, Three Valley strives to have a property closed within a year of the easement funding award notification. All closing costs associated with the easement process will come directly out of the funding award prior to the easement closing. The landowner typically does not have any upfront costs, unless a survey or appraisal is required. For a funded easement, a stewardship donation of 7% of the easement purchase price is requested. The stewardship donation ensures that we are able to legally protect and steward your property in perpetuity.

DONATED EASEMENT PROCESS

If you would like to protect your property with a donated easement, you may qualify for a significant tax deduction (more tax benefits details below). Our staff must request and receive board approval to begin your easement process. The first step is a ninety-year title search we will initiate with our title agent. Once a clean title is produced, a property visit is required to create your property Present Condition Report (PCR). Upon completion of the PCR, we will distribute a draft of the easement language for the landowner and attorney to review. When all parties have approved the easement language, the property will be ready to proceed toward closing. For a donated easement, the landowner is required to pay all associated legal and recording fees. As with funded easements, TVCT requests a stewardship donation. This fee is based on a sliding scale that is dependent of the total acreage of the easement.

Standard Easement Restrictions

- Property can not be subdivided and easements can not be extinguished or terminated without court approval.

- Impervious surface (roof and/or concrete) can not be greater than 2% of the total property acreage.

- Landowners are restricted from granting right-of-way access or easements for utilities, industrial, or commercial activities.

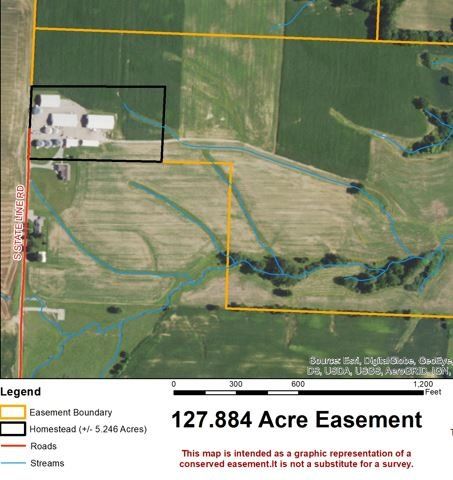

- In general, new construction must take place inside an established

building envelope(s)

also known as the

homestead area(s).

These areas are normally limited to 5% or less of the total property acreage. Homestead areas (depicted below) boundaries are established with the landowner while drafting the property's Present Condition Report and should make allowances for future land use plans.

Common Easement Misconceptions

You can’t sell your land if you have an easement on it.

Land under a conservation easement can be bought, sold, and/or transferred to heirs like any other private property transaction. The landowner never gives up title to their property, therefore, they maintain the rights to sell, lease, and manage their land.

You have to grant the public access to your land under easement.

Public access is not a requirement for conveying a conservation easement. As with any private property, the landowner chooses who to grant access to their land.

You can’t farm, hunt, fish, or harvest timber on your land under easement.

Land under easement can be actively farmed and most land uses or changes are allowable as long as they maintain or enhance the conservation goals of the easement. Hunting/Fishing is supported within state regulations. Timber harvests coordinated through a state forester are generally allowable.

You gain no significant benefits by putting your property in easement.

Conservation easements help to reduce urban sprawl, protect green spaces, provide cleaner air and water, keep prime land available for agriculture & forestry, and protect wildlife habitat. Some properties will qualify for easement funding, which will pay the landowner for their development rights and most landowners qualify for tax deductions for the donation of development rights.

Federal Tax Incentives

Stay Informed

We will get back to you as soon as possible.

Please try again later.

is a 501(c)(3) non-profit. Tax-ID 31-1418241